by admin | Feb 3, 2026 | alternative business loans, business expansion loans, large business loans

Sometimes the smartest move isn’t chasing new opportunities. It’s restructuring what you already have. Private loans for business growth aren’t just about expansion. They’re about positioning your company, financially and strategically, to...

by admin | Jan 29, 2026 | alternative business loans, large business loans, private loans for business

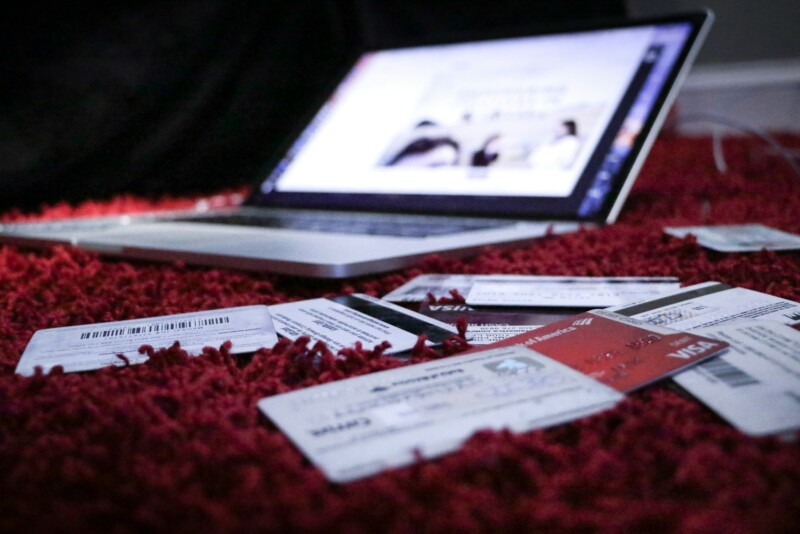

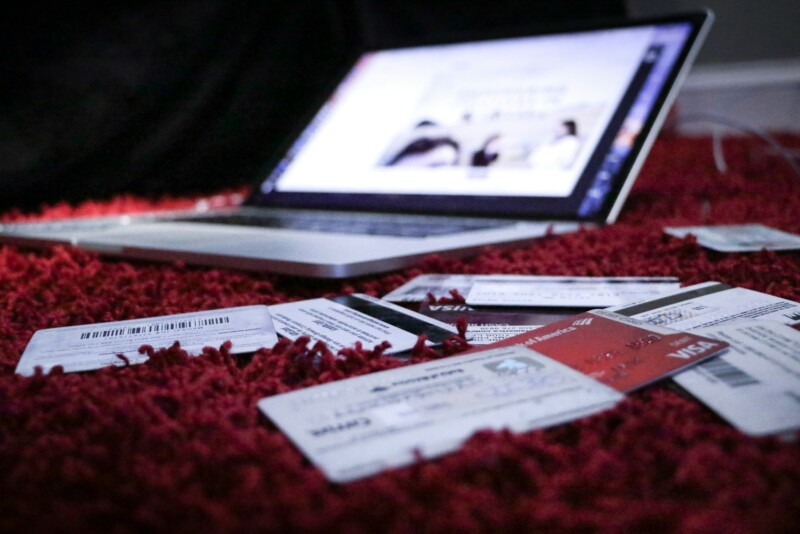

You already know how this goes. A lender sees one credit score, makes a snap judgment, and suddenly you’re treated like your business is a gamble—even when the project is strong and the leadership is proven. That’s the part that frustrates experienced operators the...

by admin | Jan 27, 2026 | alternative business loans, business loan no guarantee, private loans for business

You’ve built something real. Your business is generating revenue, you’ve got a solid plan for growth, and now you need capital to make it happen. But here’s the problem, traditional banks want you to put everything on the line. Your house. Your...

by admin | Jan 22, 2026 | business loan no guarantee, large business loans, private loans for business

Business funding can unlock new growth — but approval depends on how well you prepare. Understanding what lenders look for helps you stand out, secure funding faster, and negotiate stronger terms. At Grammont Enterprises, we’ve helped hundreds of entrepreneurs...

by admin | Jan 20, 2026 | Private Funding for Restaurants, private loans for business

The restaurant business runs on timing — but traditional lenders rarely move fast enough. Whether you’re expanding your dining space, opening a second location, or upgrading equipment, private funding for restaurants offers the flexibility, speed, and capital access...