by admin | Feb 20, 2026 | alternative business loans, large business loans, private loans for business

Ambitious projects do not fail because of vision.They fail because of capital. Whether you are developing a large commercial property, acquiring multiple companies, expanding manufacturing capacity, or launching a major infrastructure initiative, the biggest challenge...

by admin | Feb 11, 2026 | 90/10 funding for business, alternative business loans, large business loans, private loans for business

Banks have a playbook. And if your project doesn’t fit neatly into their risk boxes, solid credit, decades in business, traditional collateral they can liquidate, you’re going to hear “no.” Or worse, you’ll spend three months in...

by admin | Feb 5, 2026 | 90/10 funding for business, alternative business loans, large business loans

You’ve got a $10 million project on the table. The opportunity is real. The numbers work. The market timing is right. But here’s the problem, you don’t have $10 million sitting in the bank. And even if you did, liquidating everything you’ve...

by admin | Feb 3, 2026 | alternative business loans, business expansion loans, large business loans

Sometimes the smartest move isn’t chasing new opportunities. It’s restructuring what you already have. Private loans for business growth aren’t just about expansion. They’re about positioning your company, financially and strategically, to...

by admin | Jan 29, 2026 | alternative business loans, large business loans, private loans for business

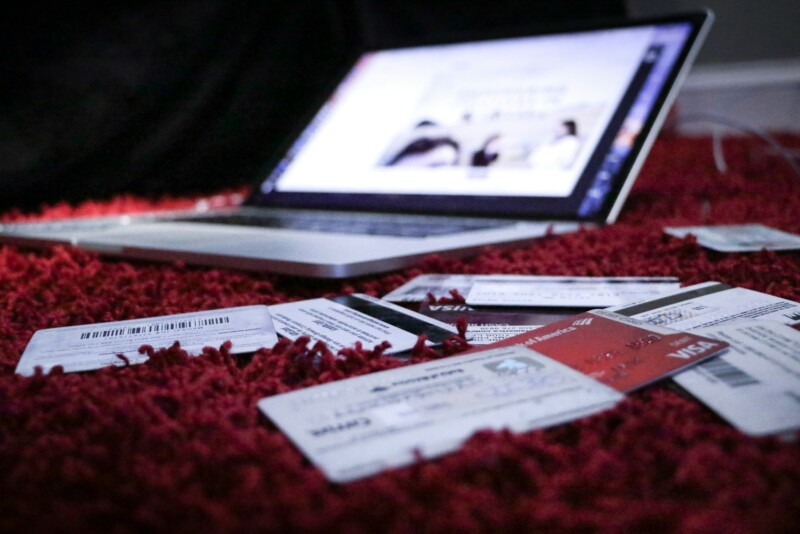

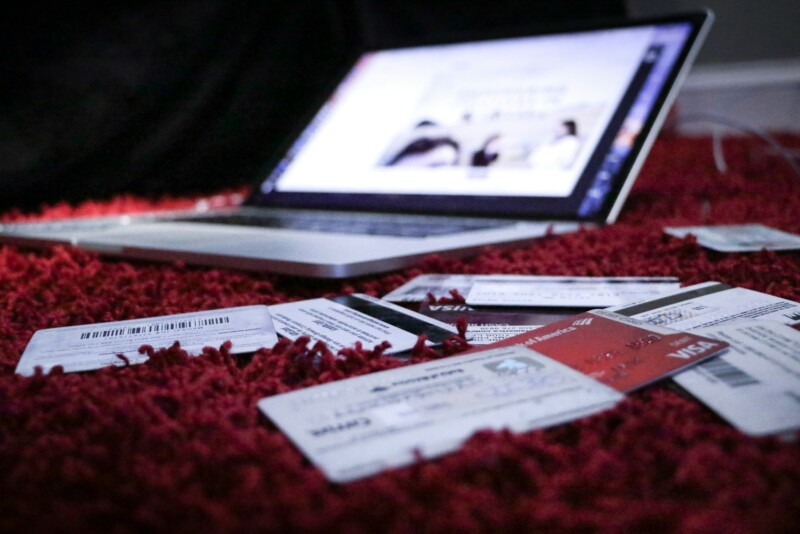

You already know how this goes. A lender sees one credit score, makes a snap judgment, and suddenly you’re treated like your business is a gamble—even when the project is strong and the leadership is proven. That’s the part that frustrates experienced operators the...

by admin | Jan 22, 2026 | business loan no guarantee, large business loans, private loans for business

Business funding can unlock new growth — but approval depends on how well you prepare. Understanding what lenders look for helps you stand out, secure funding faster, and negotiate stronger terms. At Grammont Enterprises, we’ve helped hundreds of entrepreneurs...