You already know how this goes.

A lender sees one credit score, makes a snap judgment, and suddenly you’re treated like your business is a gamble—even when the project is strong and the leadership is proven.

That’s the part that frustrates experienced operators the most.

Not the “no.” The lazy reason behind it.

If you’ve had a credit setback—medical bills, a messy split, a partner issue, a pandemic ripple—you don’t need a lecture. You need capital that looks at the whole file.

And that’s exactly what we do.

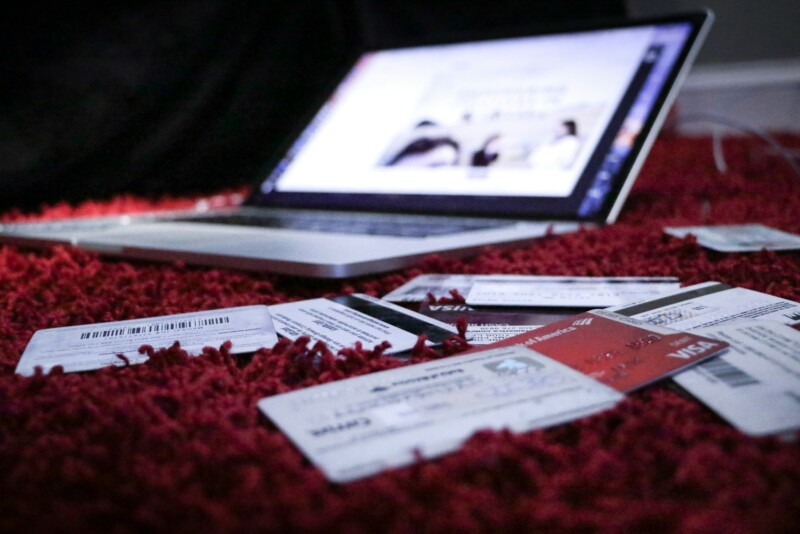

The Problem With Being Reduced to a Number

The Problem With Being Reduced to a Number

Traditional banks are built for clean files and predictable boxes.

They pull credit, compare you to a threshold, and if you miss it, the deal stalls—or dies—before anyone asks the real questions.

It doesn’t matter if you’ve built companies before.

It doesn’t matter if this new opportunity has clear demand, solid pricing, and a realistic path to cash flow.

To most banks, a credit hiccup is the headline. Everything else becomes background noise.

That’s why smart business owners freeze. They scale back. They wait out the clock. They tell themselves they’ll circle back once the score improves.

Meanwhile, the window moves.

And standing still is the riskiest move on the board.

Our Holistic Review: Credit Is In the File—Not In Charge

At Grammont Enterprises, we do review credit. Always.

But we don’t treat that three-digit number like a final verdict.

We underwrite the full picture—because the future performance of a deal rarely shows up in a single score. Our process is built to answer one question:

Is this a fundable project with a capable team and a realistic plan?

Here’s what we focus on during a holistic review:

- The business plan. Clear scope, real market logic, and a strategy that holds up under pressure.

- Financial projections. Revenue, costs, timing, and assumptions that make sense—not fantasy numbers.

- Leadership experience. Operators who’ve run teams, managed budgets, and executed in the real world.

- The opportunity. A deal structure and use of funds that’s coherent and defensible.

Credit helps us understand what happened.

The plan, projections, and leadership help us understand what’s likely to happen next.

That’s the difference.

Who This Works For (And Who It Doesn’t)

Who This Works For (And Who It Doesn’t)

This isn’t “bad credit, no questions asked.”

We’re a private lender for serious projects. Our minimum loan amount is $1 million, and we routinely fund transactions in the $10M to $100M+ range.

We’re a fit when you’re building or scaling something substantial—especially when banks are hesitant because they’re stuck on the score.

We see requests across industries like:

- Real estate — development, acquisitions, repositioning

- Healthcare — medical facilities, senior living, specialty clinics

- Construction — commercial builds, infrastructure, large renovations

- Hospitality — hotels, resorts, mixed-use projects

- And other asset-heavy, execution-driven businesses

If you’ve got a real plan, real experience, and a project that pencils—credit doesn’t have to be the gatekeeper.

Non-Recourse Funding: No Personal Guarantees

A second frustration with bank lending is the personal exposure.

At Grammont, we don’t require personal guarantees.

That means your personal assets aren’t tied to the loan. You’re not putting your home and family balance sheet on the line just to move a business project forward.

That’s non-recourse lending—and for experienced owners, it’s a smarter way to scale.

Especially after a setback, protecting what you’ve rebuilt matters.

Fast Decisions—And a Realistic Funding Timeline

Timing is everything.

Banks can stretch a “maybe” into months, then still say no. That kind of delay costs you deals, pricing, and momentum.

At Grammont, we’re direct:

- Approval is typically about 15 days. You get an answer fast enough to make real decisions.

- Funding is approximately 60 business days. It’s a process—documentation, diligence, and execution—so we don’t pretend it’s instant. We just keep it moving.

Compared to the 6–12 month grind you’ll often see in traditional channels, that timeline can be the difference between catching the window and missing it.

What Makes an Application Stand Out in a Holistic Review

If you want your file to move quickly—and get taken seriously—bring substance.

Here’s what we’re really looking for:

A business plan that’s clear enough to stress-test.

What’s the project? The market? The use of funds? The execution plan? The exit? No fluff—just clarity.

Projections that are realistic.

Conservative numbers beat aggressive guesses every time. We’d rather see a plan you can hit than a spreadsheet that only works in perfect conditions.

Leadership that can execute.

Experience matters. Not just titles—proof you’ve operated, solved problems, and delivered results.

A partner mindset.

We approach deals like a partnership. The best borrowers do too—responsive, prepared, and focused on getting it done.

When those pieces are in place, credit becomes context—not a cage.

The Real Shift: Stop Asking to Be “Allowed” to Grow

The Real Shift: Stop Asking to Be “Allowed” to Grow

A credit score is a snapshot.

It’s not your capability. It’s not your market understanding. It’s not your leadership.

The winners don’t wait around for a number to grant permission. They keep moving—strategically.

They find capital that can actually read the full story.

Ready to Talk Through Your Project?

If you’re pursuing a project of $1M+ and you’ve hit resistance because of credit, we’ll take a real look.

We’ll review the full file—credit included—but we’ll weigh it against your plan, projections, and leadership.

Schedule a conversation with our team and let’s see what’s workable.